A corporate tax return is amended by filing Form 1120X. An amended return may be required to account for information that was either not reported or incorrectly reported on the original filing. The reason for the amendment must be detailed in Form 1120X, Part II—and any forms or schedules that changed should be labeled “As Amended” and attached to Form 1120X.

I’ll walk you through the process of how to amend a corporate tax return. This includes gathering the required information, completing Parts I and II of Form 1120X, preparing the attachments, such as any form or schedule that changed from your originally filed Form 1120, and filing the form.

Key Takeaways

If you are amending a corporate tax return because income or expenses were omitted from the initial filing, then you need that new information to include in the amendment filing. Supporting documentation should be obtained for reference purposes, and you’ll also need the information from the originally filed return.

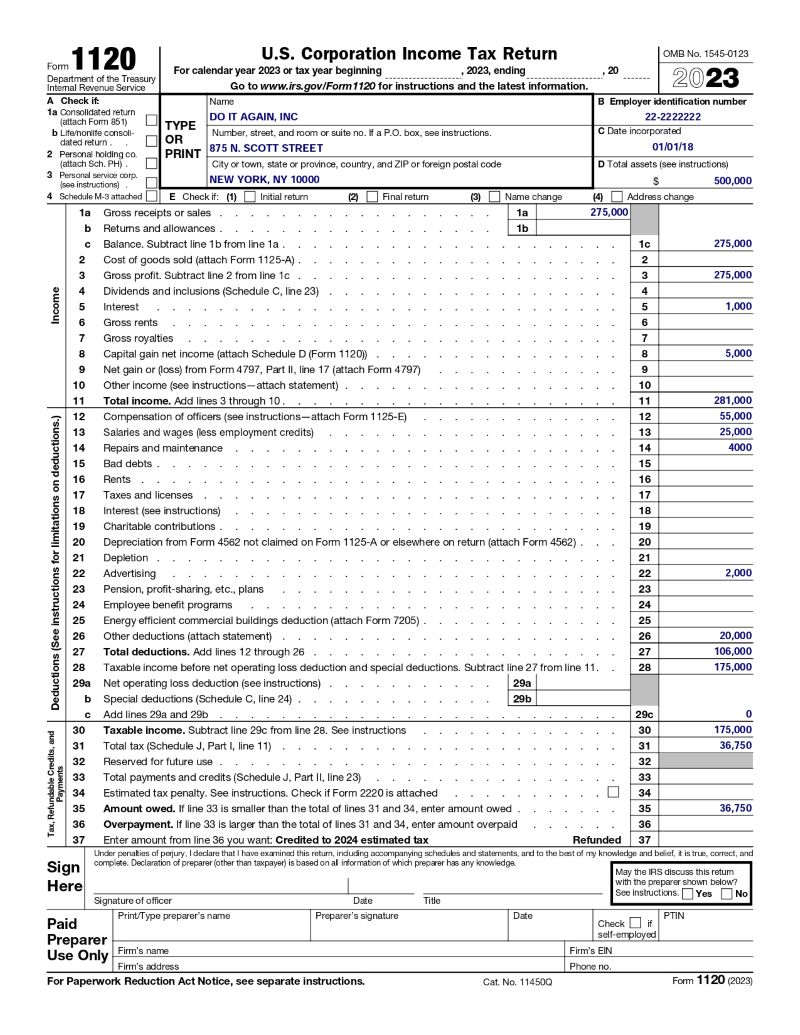

Page 1 of an initially filed return is shown below as an example. This example form will need to be amended because of missing estimated tax payments that should have been reported in the original filing on line 33.

Form 1120, Page 1, as originally filed

If you are using the same software that was used to prepare the original filing, this information should transfer automatically. Otherwise, you’ll need to complete the identifying information for the company at the top of Page 1.

This identifying information includes the name, address, employer identification number (EIN), and telephone number of the corporation filing the return, as well as the tax year for the return being amended.

Column (a) of Part I of Form 1120X references the following completed lines from the original Form 1120 shown above:

Information from the lines above should be carried to lines 1–4 of Form 1120X:

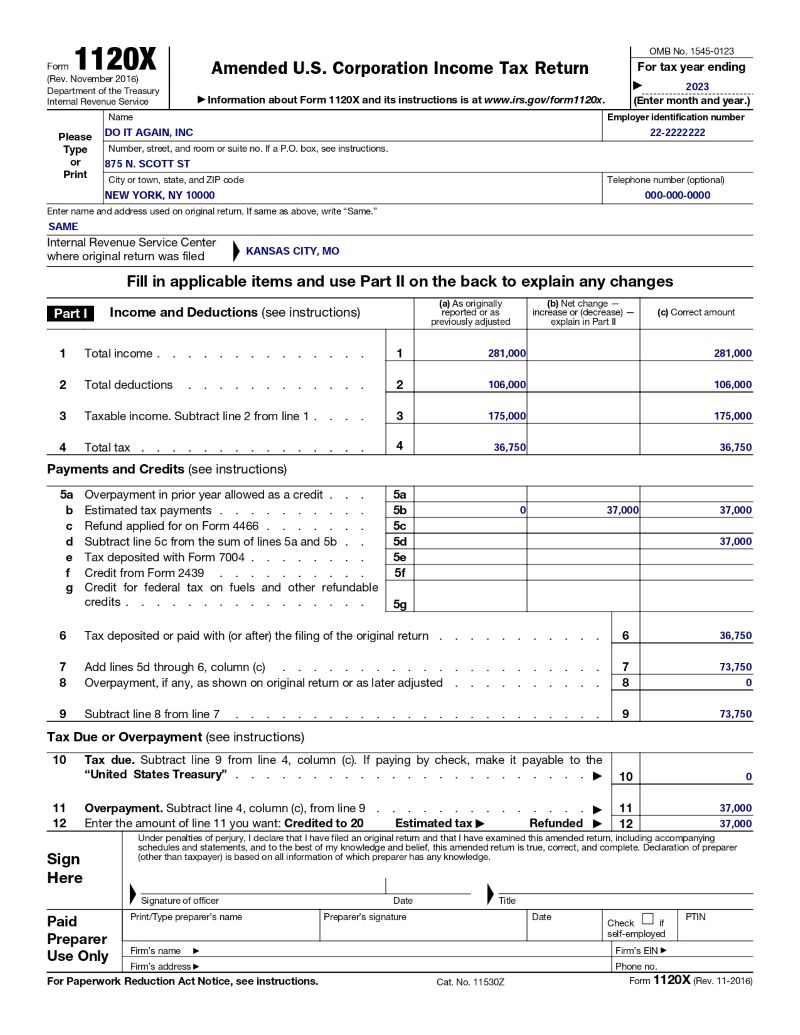

In our example above, line 33 on the original Form 1120 is blank. The estimated payments that should have been reported on that line are reported on line 5b, columns (b) and (c), of Form 1120X, Page 1.

Form 1120X, Page 1, with sample input

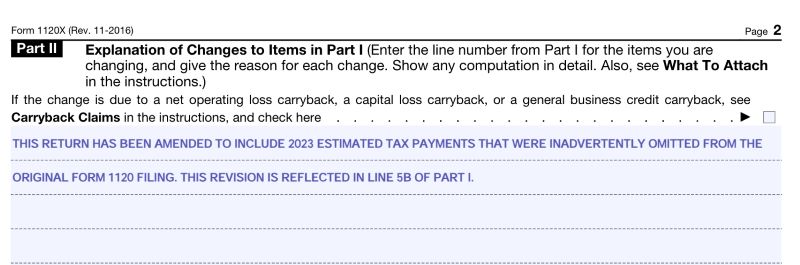

Page 2 of Form 1120X consists of an explanation for the amendment. Lines that were adjusted in Part I should be referenced in the explanation.

An example of a completed Form 1120X, Part II

I recommend attaching a new Form 1120, with each page clearly labeled at the top in large letters “As Amended.” You must also attach any form or schedule that changed from your originally filed Form 1120. These forms and schedules should also be clearly labeled “As Amended.”

For example, if officer compensation was adjusted, a revised Form 1125-E would need to be attached, labeled “As Amended,” and submitted with Form 1120X.

I also recommend attaching a copy of your originally filed Form 1120 clearly labeled as “Originally Filed” at the top of each page.

Form 1120X can be filed electronically or mailed to the IRS at the applicable address shown on the original Form 1120 instructions:

Processing time for Form 1120X may take three to four months.

The IRS has identified specific situations where Form 1120X should not be used. For the following situations, there are separate forms that should be filed.

Form 4466 (Corporation Application for Quick Refund of Overpayment of Estimated Tax) is used when the following will occur:

Instead of filing the return and waiting for the refund, Form 4466 can be filed after the corporation’s year-end (but before the due date of the Form 1120 income tax return). Form 4466 is optional but will help you get your refund faster.

For a calendar year-end corporation, a 2023 Form 4466 could be filed any time after Dec. 31, 2023, but before April 15, 2024. The IRS instructions indicate that the IRS will review the form within 45 days of filing. As of the 2023 tax year, Form 4466 cannot be e-filed.

Form 1139 (Corporation Application for Tentative Refund) is used by C-corps

C-corps use IRS Form 1139 to apply for a tentative refund. Other entity types should use IRS Form 1045. to apply for a tentative refund, usually because of the carryback of a loss. Carrying back a loss to a prior year would reduce that prior year’s income and this reduction in income could result in a refund being applied for on Form 1139.

Form 1139 must be filed within 12 months following the year that the credit or carryback was generated. If you missed this 12-month window, then you’ll need to file Form 1120X to claim your carryback. As of the 2023 tax year, Form 1139 cannot be e-filed.

Yes. A copy of the originally filed Form 1120 should be attached and clearly labeled “As Originally Filed.”

How many years back can Form 1120X be filed?Per IRS instructions, Form 1120X must generally be filed within three years after the date the corporation filed its original return or within two years after the date the corporation paid the tax (if filing a claim for a refund), whichever is later.

Which form do I use for amending a corporate tax return for Form 1120-S?Form 1120-S is amended by checking box H(4) on page 1 of Form 1120-S. The box is titled “Amended Return.”

Now that you know how to amend a corporate tax return for Form 1120, you can report changes to the original filing. If the changes made impact other schedules included in the original return, then the revised schedules should be remitted along with Form 1120X.

Liz Smith is an experienced tax specialist with focused expertise in compliance and financial planning. Liz has 11 years of experience in public accounting where she has assisted companies through all phases of business development from inception to dissolution. Liz has a B.S. in Accountancy from Arizona State University and a M.S. in Tax and Financial Planning from Widener University. Liz has written extensively for the Pennsylvania Institute of Certified Public Accountants and been featured in podcast and video presentations on their platform.